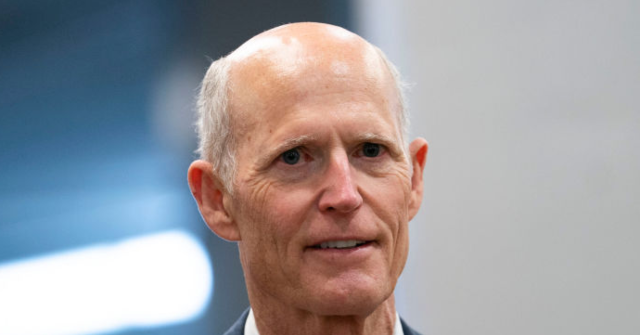

Republicans within the Senate can not win their likelihood to enhance the ‘massive, stunning invoice’, stated Senator Rick Scott (R-FL) Monday.

The invoice acquired the complete approval of the home on 22 Might in a voice of 215-214-1 and it has since been within the aim of the Senate. One of the essential gross sales arguments of the invoice is to stop a tax improve by the tax cuts of President Donald Trump 2017 everlasting, along with different tax advantages, reminiscent of no tax on suggestions and no tax on additional time – agenda articles praised by each the restaurant business and the primary respondents. For instance, the fraternal order of the police formally endorsed the invoice earlier this month and didn’t defend any tax on additional time. The Nationwide Restaurant Affiliation additionally celebrated these elements within the earlier month.

However now the invoice is within the palms of the Senate and Senator Scott calls on his colleagues to carry out it.

“I spoke with President Trump. He desires to steadiness the funds and put an finish to the created inflation nightmares, however he wants the assistance of the congress,” stated Florida’s senator.

‘Republicans in the home labored arduous on a’ massive, stunning account ‘. It’s a nice start line, however it’s our process within the Senate to make it higher according to the Trump agenda, “Scott continued.

“We can not waste this chance within the Senate to assist Trump ship American households,” he added.

His name follows the Methods and Means committee final week the file immediately after Democrats had lubricated the ‘large, stunning account’.

As Breitbart Information reported:

Democrats who’re in opposition to the invoice have claimed that it advantages the wealthy, however they’ve achieved this by fugging the figures, largely relying on the evaluation of the Congressional Funds Workplace (CBO) to feed their criticism. However as Breitbart Information reported, the CBO – based to behave as a non -party advisory physique – his efficiency and the political historical past of the workers who questioned it.

In some respects, Democrats are primarily ambiguous to take away tax -funded advantages for unlawful immigrants as the advantages of the poor. However that’s fully unfair in itself.

The Methods and Means committee corrects the file and warns the American individuals to not fall for a similar factor, the Democrats are really helpful to discredit the advantages of the Trump Tax Minimize for the 2017 working class. All in all, De Gop says that the figures are clear, which reveals that the measure improves People.

Of their reply, Republicans observed that the invoice not solely stops a tax improve of $ 1,700, but additionally gives an additional $ 1,300 in tax reductions for households of 4 who earn lower than $ 100,000. Additionally they defined how tax discount the American households with low incomes will affect essentially the most.

“With the approval of President Trump’s solely nice account, People can count on to obtain at least $ 13,300 extra in Take-House Pay,” stated secretary of the US Division of Housing and City Improvement Scott Turner Monday. “That’s extra money in your pocket to own a home and attain the American dream.”