Enterprise Reporter & Deputy Editor of the Economic system, BBC Information

Getty photographs

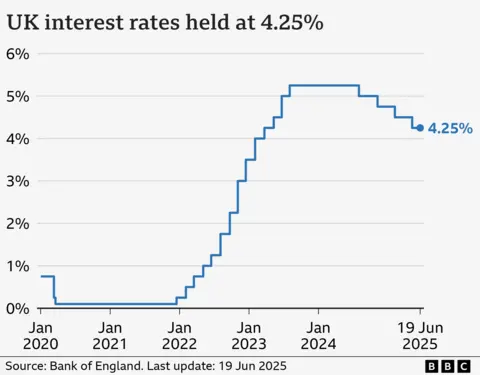

Getty photographsThe Financial institution of England has steered with additional rates of interest, which might come so shortly August.

It determined to maintain the charges on Thursday 4.25% with inflation, tariff costs rise over time and keep on the highest degree for greater than a 12 months and above the purpose curiosity of the financial institution.

Governor Andrew Bailey stated that the rates of interest “keep on a regularly downward path”, however warned, “The world could be very unpredictable.”

There are concern that the battle between Israel and Iran, a big oil producer, might ship the vitality prices increased and enhance the overall costs, which might have an effect on additional price choices.

Clare Lombardelli, deputy governor of the Financial institution of England, instructed the BBC that the “uncertainty for the financial system” led to the rates of interest held this month.

She describes occasions within the center -East as “tragic” and “deeply disturbing,” she stated, “As you’d count on, we rigorously keep watch over these occasions and the influence that they may have.”

Because the financial institution’s price committee was final met in Might, oil costs rose by 26%, whereas gasoline costs are by 11%.

Mrs. Lombardelli stated: “For instance, we’ve seen oil costs rise for the reason that assaults. However we’re considering of and have centered on the influence on British inflation and so we verify and punctiliously assess these occasions.”

The financial institution has marginated its expectations for the British financial system, however it stated that the underlying progress was “weak”.

The expansion of the UK has thus far been uneven this 12 months, with the financial system spreading strongly in the beginning of 2025, earlier than he shrinks sharply in April.

There’s indications that the tempo of wage progress – which contributes to the inflation share – slows down. On the identical time, the unemployment price of the UK has elevated and corporations are retaining or changing workers.

“Within the UK we see indicators of softening on the labor market. We are going to look rigorously within the extent to which these indicators feed on the inflation of the patron prize,” stated Mr Bailey.

The essential rate of interest of the financial institution determines the charges set by Excessive Road Banks and Menschieters.

The upper degree lately has led individuals to pay extra to borrow cash for issues like mortgages and bank cards, however savers have additionally obtained a greater return.

Susannah Streeter, head of cash and markets at Hargreaves Lansdown, stated that this 12 months there have been two rates of interest “nonetheless on the horizon”.

“In each course there’s a thriller to confront, so policymakers have assessed that it’s the best choice for now to press charges on the pause button,” she stated.

“The hope for a summer season price discount just isn’t utterly blurred, with bets set in August in August, might provide the rays of lighting that debtors have waited for.”

Strain progress on corporations

Firms have been discovered to chop wages for some workers to pay for the rise in employment prices that got here into impact in April.

Employers have been affected with a rise within the quantity of the nationwide insurance coverage insurance policies that they’re obliged to pay and will increase to the minimal wage. The financial institution estimated that the coverage adjustments by Chancellor Rachel Reeves have elevated the wage accounts by 10%.

In his analysis amongst corporations it stated that the strain on corporations had grown to get well the upper prices by rising costs, however added “Success has been combined”.

As a substitute, it stated that corporations used a collection of measures to save lots of prices, together with decreasing wage will increase for these workers simply above the minimal wage.

A weaker marketplace for everlasting workers compelled Hays, the British recruitment firm, to warn that the revenue for the complete 12 months wouldn’t be sufficient expectations.

The corporate emphasised a diminished demand within the UK and Eire, the place it expects that prices will fall by 13%. The share worth of Hays fell greater than 10% to 61.97p, the bottom for greater than 30 years.

Some corporations instructed the Financial institution of England that they hit their revenue fairly than to extend costs for patrons to cowl increased employment prices.

Inflation stays above the financial institution purpose of two%, at 3.4% within the 12 months to Might, and is anticipated to rise to three.5% later this 12 months. However it’s anticipated to return to round 2.1percentnext 12 months.

Rates of interest are an important instrument of the financial institution to attempt to keep the annual inflation price at or near its purpose.

The idea behind rising rates of interest to sort out inflation is that by making loans costlier, extra individuals will in the reduction of on expenditure and that results in the demand for falling items and the value will increase.

However it’s a balancing act, as a result of rates of interest can hurt the financial system as a result of corporations postpone in manufacturing and jobs.