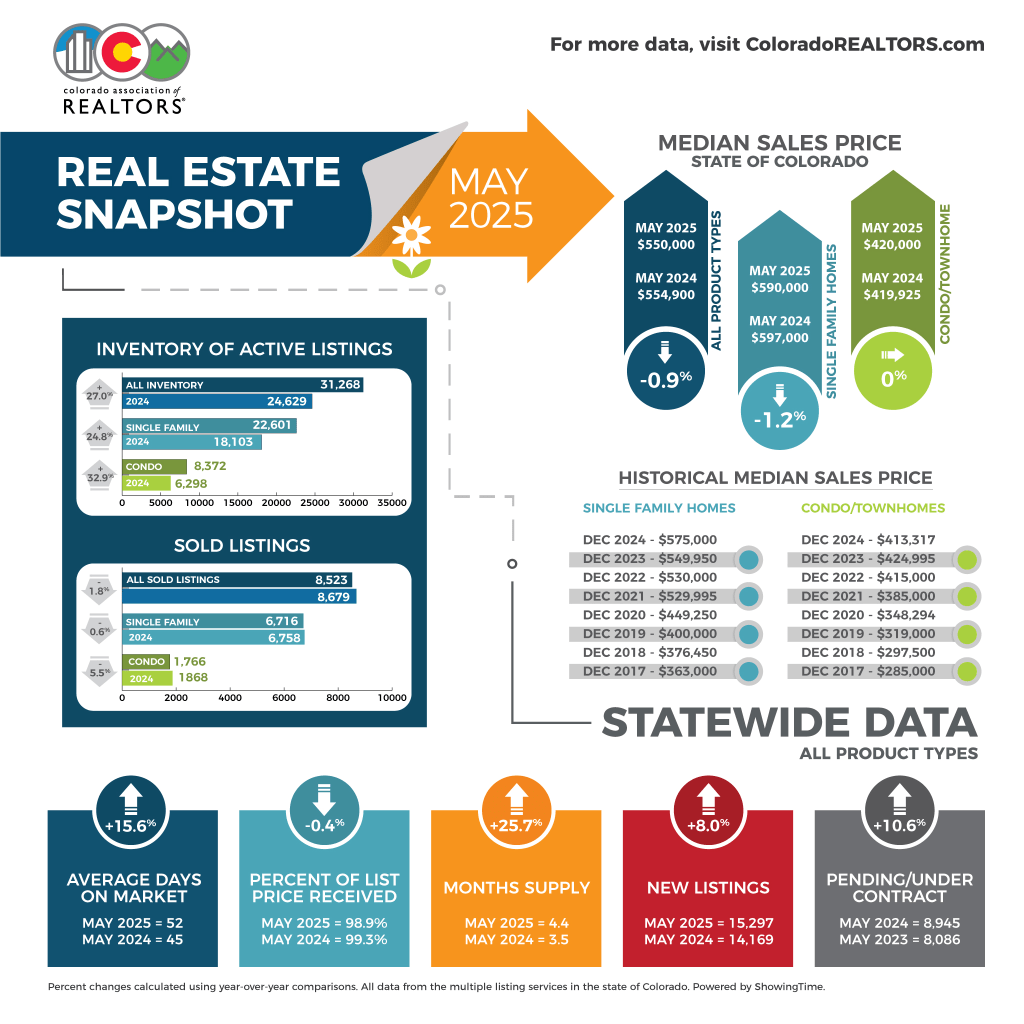

Regardless of hovering stock, at its highest stage statewide in Colorado since 2019, gross sales stay stagnant as patrons grapple with excessive rates of interest.

Sellers proceed to record their houses, realizing rates of interest are unlikely to drop quickly.

According to the Colorado Association of Realtors’ monthly market trends housing report, patrons, a few of whom have been ready for years for extra choices, both negotiate concessions and buy-downs or keep on the sidelines.

“The previous 5 years have left us questioning when the market would steadiness or be extra purchaser pleasant and, definitely, it’s now,” stated Aurora-area realtor Sunny Banka.

Colorado recorded 31,268 lively listings in Might, up 27% from Might 2024. Statewide, offered listings slipped 1.8% from a 12 months in the past, whereas pending or below contract gross sales have been up 11% from final 12 months.

Cooper Thayer, a dealer affiliate with the Thayer Group in Fortress Rock, stated increased prices maintain houses in the marketplace longer, inflicting a “pile-up” impact.

“The result’s a whopping 4.2 months’ provide of stock, setting a near-15-year file excessive,” Thayer stated.

“For the primary time in a few years, it seems we’ve entered a bona fide purchaser’s market, giving homebuyers the higher hand in negotiations,” Thayer stated.

He stated patrons who can afford increased rates of interest, insurance coverage prices, HOA dues, and property taxes can reap the market’s advantages.

Sellers will proceed to compete.

“Costs have remained secure, stock remains to be shifting (albeit slower), and plenty of potential homebuyers nonetheless have a robust underlying want to personal a Denver metro dwelling,” Thayer stated.

“It simply might take a bit extra technique, preparation, and persistence to search out the precise purchaser on your dwelling at a worth that is sensible.”

Statewide, the median worth of a single-family dwelling fell 1.5% to $590,000 from April to Might, and it’s also down 1.2% from a 12 months in the past.

Condominium-townhome median pricing rose 3.3% to $420,000 from April to Might, returning to the identical stage a 12 months in the past.

Kelly Moye of Compass in contrast the market to working on a treadmill: “Lively however not going wherever.”

Julia Purrington Paluck, an Evergreen realtor, stated the mountain metro market is experiencing its highest stock in a decade.

“Within the foothills, we often see peak stock in August or September. However, as of the top of Might 2025, we’re experiencing the best stage of lively listings in over a decade – about 36% extra houses in the marketplace in comparison with Might 2024, and greater than double what we noticed in Might 2023.”

Regardless of the bounce in stock, demand stays low.

“Not many individuals are keen to surrender their 2.5%-3.5% mortgage charges to buy with a 6% charge,” she stated.

Which will point out dwelling costs will start dropping.

“Excessive provide and low demand point out this received’t final,” she stated. “The legal guidelines of provide and demand recommend we’re headed for some worth changes.”

The information and editorial staffs of JS had no position on this publish’s preparation.