BBC

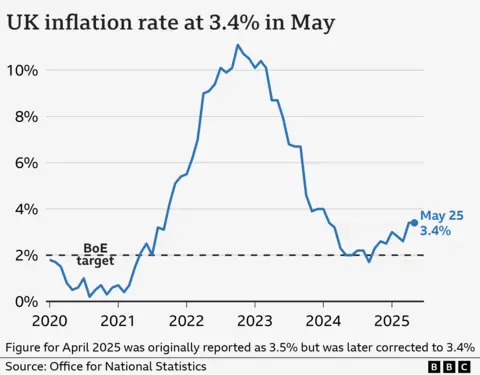

BBCThe costs within the UK rose by 3.4% within the 12 months to Could, fed by larger meals costs, together with chocolate.

It implies that inflation stays above the goal of two% of the Financial institution of England.

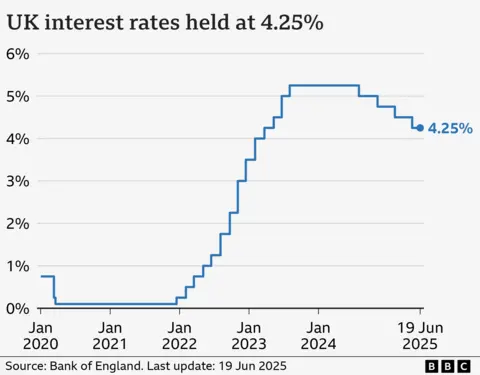

The financial institution strikes the rates of interest up and all the way down to attempt to preserve inflation at that stage and has lowered rates of interest 4 occasions since August 2024.

What’s inflation?

Inflation is the rise within the worth of one thing over time.

For instance, if a bottle of milk is £ 1 solely £ 1.05 a yr later, the annual milk inflation is 5%.

How is the inflation of the UK measured?

The costs of a whole bunch of every day articles, together with meals and gasoline, are adopted by the workplace for nationwide statistics (us).

This digital “basket of products” is commonly up to date to show retailer tendencies, with Virtual reality headsets and yoga mats added in 2025and native newspaper ads eliminated.

The financial institution additionally regards different measures resembling “core inflation” when deciding whether or not and find out how to change the charges.

It doesn’t embody meals or vitality costs as a result of they are typically very risky, so a greater indication of tendencies in the long term could be.

Core CPI was 3.5% within the yr to Could, in comparison with 3.8% in April.

Why nonetheless costs rise?

Inflation has fallen significantly since he reached 11.1% in October 2022, which was the very best proportion for 40 years.

Nonetheless, that doesn’t imply that costs are falling – simply that they’re rising much less rapidly.

Inflation elevated in 2022 as a result of oil and gasoline had been extra demand for the Covid -Pandemie, and vitality costs rose once more when Russia invaded Ukraine.

It then remained properly above the goal of two% partly attributable to larger meals costs.

Why does the preparation of rates of interest assist to cut back inflation?

When inflation was properly above the goal of two%, the Financial institution of England elevated rates of interest to five.25%, a spotlight of 16 years.

The concept is that in case you make borrowing costlier, individuals have much less cash to spend. Folks may also be inspired to avoid wasting extra.

This in flip reduces the demand for items and the worth will increase slows down.

However it’s a balancing act – rising mortgage prices danger harming the financial system.

For instance, owners are confronted with larger mortgage repayments, which might outweigh higher financial savings agreements.

Firms additionally borrow much less, which implies they’re much less inclined to create jobs. Some can scale back employees and scale back investments.

What occurs to the British rates of interest and when will they go down once more?

The Financial institution of England has lowered the charges in August and November 2024, and once more in February and Could 2025, Take rates up to 4.25%.

It Kept rates in JuneHowever the governor of Financial institution of England, Andrew Bailey, indicated that additional “gradual and cautious” cutbacks might observe – maybe already in August.

Mr Bailey, nevertheless, warned that too The introduction of American rates has proven “how unpredictable the world financial system could be”.

The financial institution now expects the charges to decelerate the British financial system and result in decrease inflation than anticipated.

It had beforehand stated that it might seize inflation between July and September 2025 at 3.7% earlier than he fell again by the top of 2027.

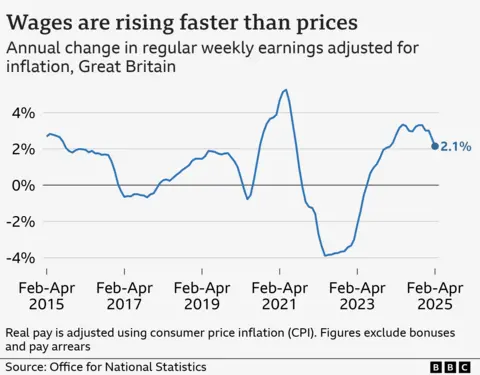

Are wages when maintaining with inflation?

As often the case, the earnings of the non-public sector has risen barely greater than the general public sector.

What occurs to inflation and rates of interest in Europe and the US?

The American and EU international locations have additionally tried to restrict the worth will increase.

The inflation proportion for international locations that used the euro was 2.2% in April 2025, the identical as in March and one thing lower of two.3% in February.

In June 2024, the European Central Financial institution (ECB) lowered its most necessary rate of interest of a document excessive from 4% to three.75%, the primary lower of the 5 years.

In June 2025, after varied cutbacks, The most important rate was 2%.

Inflation in the US fell to 2.4% in Maywhich had risen of two.3% final month. It stays above the goal of two% of the US central financial institution.

After a collection of cutbacks within the final a part of 2024, the US central financial institution once more selected to maintain charges throughout his assembly of June 2025, The fourth hold in a row.

That leaves its most necessary curiosity unchanged in a variety of 4.25% to 4.5%.

The Federal Reserve has are repeatedly attacked by President Trumpwho needs to see additional rates of interest.