The Great Tokenization: How the WEF Plans to Own Everything Through Digital Control

When Klaus Schwab promised “you’ll own nothing and be happy,” he wasn’t joking. Now his successor is making it happen through blockchain.

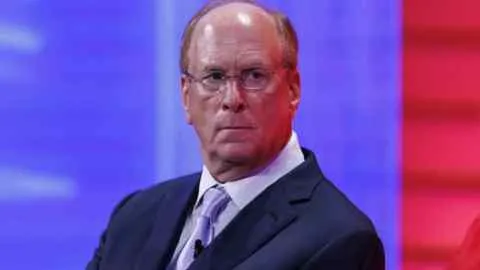

The World Economic Forum just made its most audacious power grab yet, appointing BlackRock CEO Larry Fink—a man who controls $10 trillion in assets and once bragged about his power to “force behaviors” on companies—as interim co-chair alongside André Hoffmann. This isn’t just a leadership change. It’s the merger of global financial power with the WEF’s dystopian vision of total control through what they’re calling “tokenization of everything.”

From “You’ll Own Nothing” to “We’ll Tokenize Everything”

Larry Fink has been remarkably open about his vision for the future: “We believe the next step going forward will be the tokenization of all assets and that means every stock and every bond will have its own, basically, CUSIP. It will be on one general ledger.”

But he didn’t stop there. In what should send chills down every freedom-loving person’s spine, Fink revealed the true endgame: “Every investor, you and I, will have our own number, our own identification.”

Read that again. Your own number. Your own identification. Not to protect you—to track you, monitor you, and ultimately control you.

The Digital Prison Takes Shape

Fink’s “tokenization” vision isn’t about making investment more accessible, despite his claims of “democratizing investing.” It’s about turning every asset on Earth—stocks, bonds, real estate, forests, water, farmland, even the air you breathe—into digital tokens that can be monitored, controlled, and confiscated at the click of a button.

“What exactly is tokenization?” Fink wrote in his 2025 Chairman’s Letter. “It’s turning real-world assets—stocks, bonds, real estate—into digital tokens tradable online. Each token certifies your ownership of a specific asset, much like a digital deed.”

Notice the sleight of hand? Your “digital deed” exists only on their blockchain, on their servers, subject to their rules. When everything you own exists only as a digital token on a system they control, you don’t actually own anything. You have permission to access it—permission that can be revoked.

The Infrastructure of Control: CBDCs and Digital IDs

To make this tokenized prison work, Fink is openly championing two essential components:

Central Bank Digital Currencies (CBDCs): Programmable money that can be turned off, restricted, or confiscated based on your behavior, social credit score, or political views.

Digital IDs: A mandatory identification system that links your identity to every transaction, movement, and interaction. No privacy. No anonymity. Total surveillance.

Fink himself admitted this is necessary for his vision: “We can rid ourselves of all issues around illicit activities around bonds and stocks and digital by having tokenization… We would have instantaneous settlement.”

Translation: They want to eliminate cash and anonymous transactions entirely. Every penny you spend, every asset you own, every trade you make—all visible, all traceable, all controllable.

Bitcoin: The Trojan Horse

Here’s where it gets truly insidious. Fink has recently become Bitcoin’s biggest institutional cheerleader, predicting Bitcoin could reach $700,000 if sovereign wealth funds allocate just 2-5% to it. BlackRock’s Bitcoin spot ETF approval in 2024 was celebrated as “crypto’s institutional victory.”

But why would the man building a digital control grid suddenly champion a decentralized currency?

Because they’re not promoting actual Bitcoin—they’re promoting their custodial, regulated, trackable version of it. When you “own” Bitcoin through BlackRock’s ETF, you don’t control the keys. They do. You’re not holding Bitcoin; you’re holding an IOU from BlackRock that says you own Bitcoin. Big difference.

The plan is to use Bitcoin’s popularity to onboard millions into the digital financial system, then gradually transition them into CBDCs and tokenized assets where they have complete control. Bitcoin becomes the gateway drug to digital financial slavery.

The “Force Behaviors” Philosophy

Let’s not forget what Larry Fink said in 2017: “Behaviors are going to have to change, and this is one thing we’re asking companies. You have to force behaviors, and at BlackRock, we are forcing behaviors.”

This isn’t just corporate speak. Fink was describing ESG (Environmental, Social, and Governance) investing—using BlackRock’s massive financial leverage to compel companies to adopt specific political and social agendas, regardless of whether shareholders or customers want them.

Now imagine that same “force behaviors” mentality applied to your personal finances through tokenization and digital ID. Don’t comply with ESG mandates? Your digital wallet gets restricted. Question the narrative? Your social credit score drops, and suddenly you can’t buy plane tickets. Attend a protest they don’t like? Your CBDC account gets frozen.

This isn’t speculation. It’s exactly what happened to Canadian truckers when Trudeau froze their bank accounts during the Freedom Convoy. Now imagine that power globalized and automated through blockchain.

Tokenizing Nature: The Ultimate Land Grab

The ambition extends far beyond financial assets. Fink and the WEF are pushing to tokenize natural resources: forests, rivers, water systems, fisheries, farmland, even breathable air.

Once these natural resources are “tokenized,” they become tradable investment assets owned by… BlackRock and similar institutions. The forest that your family has hunted in for generations? Now it’s been tokenized and sold to foreign investors. The water rights for your farm? Tokenized and traded on Wall Street.

As one astute observer noted: “If you thought your house was at risk, wait until your breathing air has a shareholder.”

This is the ultimate enclosure movement—turning the commons into privately owned, digitally controlled assets that can be bought, sold, and restricted by the ultra-wealthy.

The WEF Connection: “Public-Private Cooperation”

Fink’s appointment as WEF co-chair isn’t coincidental. The World Economic Forum has long pushed for what they call “stakeholder capitalism” and “public-private partnerships”—corporate-speak for merging government power with corporate power to control populations.

Fink and Hoffmann described their appointment as marking “a pivotal transition” and emphasized their goal to “strengthen public-private cooperation and promote broad-based prosperity through open markets and stakeholder capitalism.”

Translation: We’re going to use government regulatory power to force our tokenization agenda on everyone, dressed up in the language of “democracy” and “prosperity.”

The WEF’s 2030 Agenda—famous for the phrase “you’ll own nothing and be happy”—is being implemented through tokenization. You won’t own your home, your car, or your investments in any meaningful sense. You’ll have digital tokens granting you conditional access to these things, revocable at any time by the institutions that actually control the blockchain.