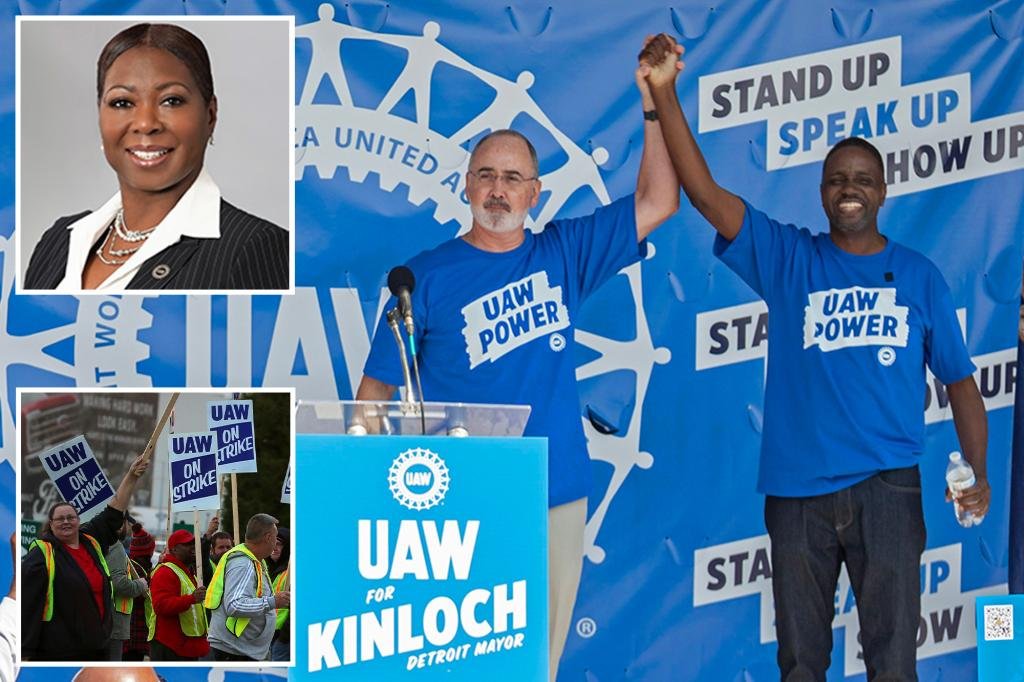

An odd funding blunder may need value the United Auto Employees union a colossal $80 million, in line with a report on Monday.

The union’s board voted in August 2023 to liquidate about $340 million in inventory investments to pay placing employees beginning the next month, and ordered the remaining funds be rapidly re-invested after the protests ended.

Strikes led to October 2023 after only one month of picketing – however greater than a yr later, that money had nonetheless not been re-invested, in line with UAW officers, union staff and paperwork reviewed by Reuters.

If the portfolio had been swiftly re-invested in shares, the UAW – which represents 400,000 employees, together with many at Common Motors, Ford and Stellantis – may need earned $80 million extra, union workers mentioned in an evaluation from February.

The UAW didn’t instantly reply to The Put up’s request for remark.

Board members grew suspicious late final yr and began questioning why the union’s return on its portfolio appeared so small in comparison with total beneficial properties within the inventory market, in line with paperwork and 5 sources conversant in the matter.

At one assembly, UAW President Shawn Fain requested why he might get increased beneficial properties in a checking account than the UAW was reaping, in line with 4 folks current on the gathering.

It turned out that the union’s strike fund had been used to pay employees $500 per week, however slightly than investing the rest in shares, it was positioned in a mixture of money, fixed-income and different property in September 2024, in line with paperwork considered by Reuters.

Union staffers offered the $80 million determine in February 2025. Their evaluation didn’t embody the methodology used to succeed in that quantity, although sources mentioned it was based mostly on a comparability of precise outcomes to what the returns would have been within the inventory market.

The matter is now being investigated by a federal monitor that was appointed as a part of a 2020 settlement between the union and the Division of Justice over a multi-year corruption probe.

Duty for UAW’s investments is shared by the union president, secretary-treasurer and its three vice presidents, Michael Nicholson, lawyer for Secretary-Treasurer Margaret Mock informed Reuters.

“We welcome the monitor’s overview relating to investments, as a result of we imagine that any accusations towards Margaret Mock are unfounded,” he added.

Tensions have been brewing between Mock and Fain, with the latter inappropriately stripping Mock of a few of her duties in February 2024 as a result of she wouldn’t authorize sure expenditures associated to strike preparations, in line with a report by the union’s federal monitor.

The union’s board seems to have taken Fain’s facet within the funding snafu, writing in an announcement that she’s underneath investigation by the federal monitor “for a major compliance failure relating to our union’s investments.”

Segal Marco Advisors labored with the union to handle its $1 billion strike belief, in line with paperwork and sources.

The agency didn’t instantly reply to The Put up’s request for remark.